As we all know, one of the best aspects of shopping online is avoiding paying sales tax (with exceptions for making purchases on a site with a physical presence in your state). Depending on where you live, that can translate into significant savings over the course of a year compared to purchasing the same items at a local retailer, even when accounting for potential shipping charges. On the flip side, as an online retailer you enjoy the advantage of being instantly competitive. For many retailers based in sales tax free states such as Oregon sales tax is never even a consideration.

However, those blissful days of a sales tax free Internet may be coming to an end. On April 17, 2018 the United States Supreme Court heard a case known as South Dakota v. Wayfair, Inc.. The crux of this case is that several states have argued that this climate of sales tax free interstate Ecommerce is causing significant harm to the revenue of the states as well as brick and mortar businesses. The last time this issue had been considered in the Supreme Court was 1992, when online shopping was it its absolute infancy and few at that time could foresee the immense power and influence of Internet retailers in today’s world.

Although the legalities of all this are far beyond our area of expertise, by all accounts there is a very strong likelihood the Supreme Court may decide in favor of the states when it makes its decision later in the summer of 2018. Any person who owns an Ecommerce store would do very well to pay close attention to the case, for its ramifications can be immense.

As an online retailer, how can this affect my business?

While the details remain to be seen, one potential impact is that you may be required to collect tax on all purchases in accordance with the purchaser’s location. Thus, if your Ecommerce store is based in Oregon you will be required to collect Texas sales tax on purchases originating from Texas, New York sales tax from customers in New York, and so on. Since this Oregon-based Ecommerce store had never had to deal with Sales Tax, this would present enormous challenges, both on the technological end of the Ecommerce site, but also on the administrative/accounting aspect of the business as well. While we can’t offer legal advice, we can offer some technical tips.

Charging Sales Tax with WooCommerce

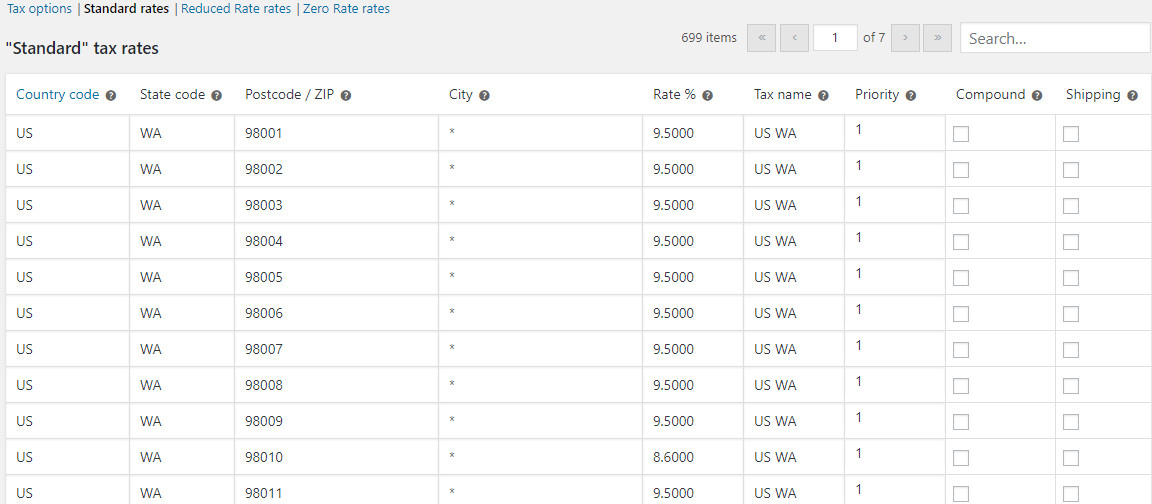

Fortunately for WooCommerce store owners, charging sales tax is rather straightforward out of the box. Currently, as a general rule online retailers charge sales tax on customers located within the state in which they have a physical presence. (NOTE: Be sure to consult with your legal team and accountant to determine precisely what the requirements are for your particular situation!) From the WordPress admin panel, you can go to WooCommerce->Settings and choose the Tax tab. From here you have a choice of general options. The challenging part is incorporating the correct tax rates. To do this, you’ll need to navigate to the Standard Rates tab. From this screen you can add and modify all the tax rates you will need based on your circumstances.

On the simple end of the spectrum are states such as Alaska that charge a uniform sales tax for the entire state regardless of zip code. In this case you can easily add one line for State=AK, a zip of *, and a rate of 5% and be done. However, most states charge varying sales tax by zip code, as can be seen in the above screenshot of a small partial list of Washington tax rates. Entering these in manually would be a tedious pain, and some automation is desireable. There are plugins that will allow you to generate and upload tax tables per state, and for these single-state cases work rather well and generally have very little initial cost and no recurring fees.

In the case that tax has to be collected from multiple states (and many Ecommerce retailers are currently required to do so based on their particular business models, but as mentioned above may become a universal requirement in the not-too-distant future), things become very complicated. Uploading tax tables for the 45 states that charge sales tax with thousands of variations (all of which subject to change) can become unmanageable. For those scenarios, connecting to a real-time API can be well worth it, even though there will likely be monthly recurring fees. Some examples include using TaxJar and TaxCloud. These services will often help you with tax reconciliation based off of your WooCommerce order history. As always, consult with your accounting team to determine which solution is best for your business.

In summary, collecting sales tax is a fact of life for the vast majority of brick and mortar retailers in the US, and may soon become a rapidly growing part of Ecommerce regardless of where you are located. Even if your location has blessed you with the ability to more or less completely ignore sales tax, that may very well change. We recommend developing a contingency strategy now should the days of a tax-free Internet become a thing of the past.